Credit Cards for Limited Credit

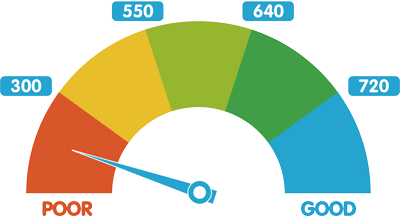

Having limited credit can sometimes be a challenge. How are you expected to build your credit when no lenders are willing to give you a chance? This question is something that we will all encounter, and fortunately, there is a simple answer. There are credit cards available for limited credit cards. In fact, many credit cards are intended for people with limited credit, such as recent college graduates. The best part about applying for a limited credit card is that you will be one step closer to building your all-important credit rating, and boosting that score! It will not be long before you can look at better options suited to your financial requirements. below you will find an extensive list of some of the best credit cards for those with limited credit. Start your search now!